-

Compound

The compound is a decentralized lending and borrowing protocol that allows users to earn interest on their cryptocurrency assets by providing liquidity to the protocol.

It offers a variety of assets to lend and borrow, including stablecoins and various cryptocurrencies.

-

Uniswap

Uniswap is a dApp Development decentralized exchange protocol that allows users to provide liquidity to the exchange in exchange for a share of the transaction fees generated by the platform. It offers a wide variety of assets to trade, including stablecoins and various cryptocurrencies.

-

Aave

Aave is a decentralized lending and borrowing protocol that allows users to earn interest on their cryptocurrency assets by providing liquidity to the protocol. It offers a variety of assets to lend and borrow, including stablecoins and various cryptocurrencies.

-

Yearn Finance

Yearn Finance is a suite of decentralized finance (DeFi) protocols that optimise users' yield farming strategies. It is developed by an experienced cryptocurrency development service provider that offers a variety of yield farming products and services, including a decentralized exchange (DEX) aggregator and a lending platform.

-

Balancer

The balancer is a DApp Development decentralized exchange protocol that allows users to provide liquidity to the exchange in exchange for a share of the transaction fees generated by the platform. It offers a wide variety of assets to trade, including stable coins and various cryptocurrencies.

Again, it's important to note that these platforms carry their own set of risks, and it's important for investors to thoroughly research and understand the risks before participating.

Dev Technosys offers expert dedicated developers under a flexible Time and Material model to turn your vision into powerful, scalable digital solutions

Welcome to our beginner's guide to DeFi yield farming!

This guide will introduce you to DeFi farming and provide an overview of the different types of yield farming strategies that can be employed. We will also discuss the potential benefits and challenges of DeFi farming and provide some tips for investors looking to participate in this high-risk, high-reward strategy.

This guide will provide a comprehensive overview of DeFi farming and help you understand the various strategies and risks involved. We hope this guide will provide a helpful starting point for investors looking to learn more about this exciting and rapidly evolving area of the cryptocurrency market. So, let's get started!

What is DeFi Yield Farming?

DeFi yield farming, also known as liquidity mining, is a way for users to earn rewards for providing liquidity to decentralized finance (DeFi) protocols. These protocols often offer automated market maker (AMM) pools that allow users to tradecryptocurrencies and other assets in a decentralized manner.

Users can deposit their assets into an AMM pool to participate in yield farming. The assets are then used to facilitate trades on the protocol, and the user receives a share of the trading fees as a reward.

Some DeFi protocols also offer additional incentives, such as governance tokens or other bonuses, for users who provide liquidity. Hence countless industrialist wants to invest in these platforms by hiring cryptocurrency development service providers.

Yield farming can be a lucrative way to earn passive income, but it carries risks. The value of the assets being deposited into the AMM pool may fluctuate, and there is always the risk of the DeFi protocol experiencing technical issues or being hacked.

Additionally, the highly speculative nature of yield farming may not be suitable for all investors.

Top 5 DeFi Yield Farming Platforms To Invest In 2023

It's important to note that cryptocurrency markets are highly volatile and DeFi farming carries risks. It's important for investors to thoroughly research and understand the risks before participating in any yield farming strategy. With that said, here are five DeFi farming platforms that have gained some popularity in the industry:

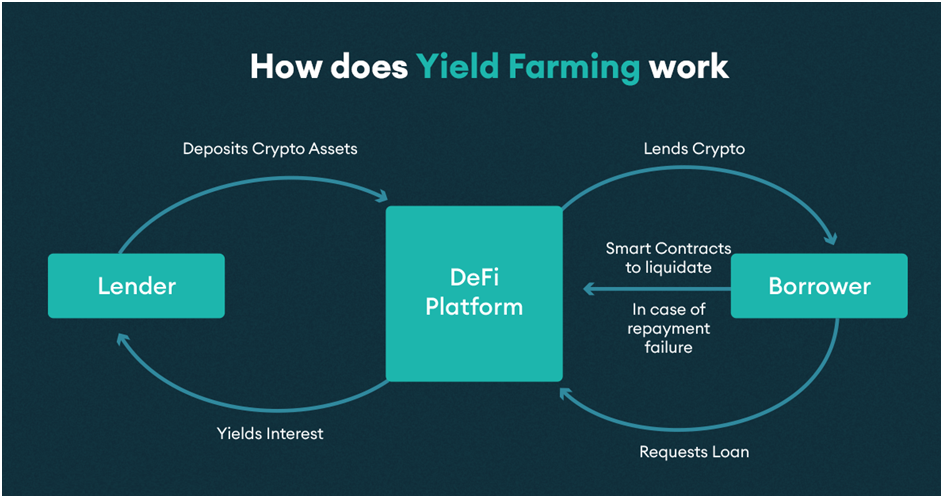

How Does DeFi Yield Farming Work?

Yield farming allows users to earn rewards for providing liquidity to decentralized finance (DeFi) protocols. These protocols often use automated market maker (AMM) pools to facilitate trades in a decentralized manner. Users can deposit their assets into an AMM pool to participate in yield farming.

The assets are then used to facilitate trades on the protocol, and the user receives a share of the trading fees as a reward. The reward amount is typically based on the amount of liquidity the user provides and the overall trading activity on the protocol.

You can hire the best Ethereum development company to create a platform for farming that may enhance business goals. Some DeFi protocols also offer additional incentives, such as governance tokens or other bonuses, for users who provide liquidity. These incentives can add to the overall return that a user can earn through yield farming.

It's important to note that yield farming carries risks. The value of the assets being deposited into the AMM pool may fluctuate, and there is always the risk of the DeFi protocol experiencing technical issues or being hacked, so hire the best Ethereum development company to get high security. Additionally, the highly speculative nature of yield farming may not be suitable for all investors.

Types of DeFi Yield Farming

DeFi yield farming, also known as liquidity mining, is a strategy used to earn returns on cryptocurrency assets by providing liquidity to decentralized finance (DeFi) protocols. There are several different types of yield farming strategies that can be employed, including:

-

Staking

Staking involves holding a certain amount of cryptocurrency in a wallet and participating in the consensus process of a proof-of-stake (PoS) blockchain. By participating in the validation of transactions, stakers can earn rewards in the form of newly minted coins or transaction fees.

-

Lending

DeFi lending protocols allow users to lend their cryptocurrency assets to borrowers in exchange for interest payments. Lenders can earn returns by providing liquidity to the protocol and setting the terms of their loans. However, hire a blockchain development company if you want to invest in such.

-

Trading

Some DeFi protocols offer yield farming opportunities by providing liquidity to decentralized exchanges (DEXs). By providing liquidity to a DEX, traders can earn a share of the transaction fees generated by the exchange.

-

Governance

Some DeFi protocols offer yield farming opportunities through their governance models. Users can earn rewards from tokens or other cryptocurrency assets by participating in the governance process and voting on protocol updates.

-

Providing Collateral

Some DeFi protocols allow users to provide collateral in the form of cryptocurrency assets in exchange for the right to borrow a different asset. By providing collateral to these protocols, users can earn returns in the form of interest on their collateral.

It's important to note that DeFi yield farming can be a high-risk, high-reward strategy, so it is important to hire a blockchain development company to create a prominent security-based platform to avoid such cases.

What Are The Benefits of DeFi Yield Farming?

Let's dive into these sections to learn some of the incredible benefits of yield farming. There are several potential benefits to participating in DeFi farming, including:

-

Potential for High Returns

DeFi farming can offer the potential for high returns on cryptocurrency assets, particularly when the demand for a particular asset is high and the supply is limited.

However, it's important to note that these high returns come with a high level of risk, and it's important for investors to thoroughly research and understand the risks before participating.

-

Diversification

DeFi yield farming can provide an opportunity to diversify one's portfolio of cryptocurrency assets and potentially earn returns on a wider range of assets.

Hence if you have developed an interest in yield farming, then knowing about the cost to create ERC20 tokenis important.

-

Access to New Projects and Protocols

DeFi yield farming can provide access to new and emerging projects and protocols that may not be widely available or well-known. It can provide the opportunity to earn returns on these assets before they become more widely adopted.

-

Decentralization

DeFi protocols are decentralized, meaning a single entity does not control them. It can give users greater control over their assets and potentially reduce the risk of censorship or interference.

-

Transparency

Many DeFi protocols are built on open-source blockchain technologies, which can provide transparency and accountability not found in more traditional financial systems.

It's important to note that DeFi yield farming carries its own set of risks, including the risk of losing one's investment, the risk of security breaches or hacks, and the risk of regulatory uncertainty. Investors should carefully consider these risks before participating in DeFi farming.

What Challenges Can Be Faced in DeFi Yield Farming?

DeFi yield farming can be a high-risk, high-reward strategy and carries its challenges. Some potential challenges that investors may face when participating in DeFi farming include the following:

-

Volatility

Cryptocurrency markets are known for their volatility, and DeFi yield farming can be particularly risky due to the highly speculative nature of the assets being traded. Prices can fluctuate dramatically in a short time, which can lead to significant losses for investors.

-

Lack of Regulation

DeFi protocols operate in a largely unregulated space, making it difficult for investors to protect their assets or seek recourse if something goes wrong.

-

Security Risks

DeFi protocols are built on open-source blockchain technologies, which can make them vulnerable to hacks and security breaches. Investors should carefully research the security measures before participating in DeFi yield farming.

-

Complexity

DeFi yield farming can be complex and may require a high level of technical knowledge to participate. It can make it difficult for some investors to understand the risks and rewards of yield farming fully.

-

Gas Fees

DeFi protocols built on the Ethereum blockchain rely on gas fees to facilitate transactions. These fees can be high during times of high demand, making it costly to participate in DeFi yield farming.

-

Market Saturation

As DeFi yield farming has become more popular, the market has become saturated with many competing protocols. It can make it difficult for investors to differentiate between good and bad investment opportunities. It can also lead to a race to the bottom as protocols compete for liquidity.

How To Do DeFi Yield Farming?

DeFi yield farming, also known as liquidity mining, is a strategy used to earn returns on cryptocurrency assets by providing liquidity to decentralized finance (DeFi) protocols. Here is a general outline of how to participate in DeFi yield farming:

-

Research

It's important to thoroughly research and understand the risks and rewards of DeFi yield farming before participating. It includes researching the DeFi protocol or platform you are considering and understanding the yield farming opportunity's specific terms and conditions.

-

Choose a DeFi Protocol or Platform

Several DeFi protocols and platforms offer yield farming opportunities, each with its own set of assets, terms, and conditions. It's important to carefully consider which protocol or platform is right for you and your investment goals.

-

Set up a Wallet

To participate in DeFi yield farming, you will need a cryptocurrency wallet compatible with your protocol or platform. It may require downloading a specific wallet or using a specific type of wallet, such as a hardware wallet.

-

Provide Liquidity

To participate in DeFi yield farming, you must provide liquidity to the protocol or platform through cryptocurrency assets. It may involve transferring assets from your wallet to a specific DeFi protocol or platform or providing assets as collateral for a borrowing or lending opportunity.

-

Earn Rewards

By providing liquidity to a DeFi protocol or platform, you can earn rewards through cryptocurrency assets or other rewards. These rewards may be paid out regularly or may be paid out when you choose to withdraw your liquidity from the protocol or platform.

It's important to note that DeFi yield farming carries its own set of risks, including the risk of losing one's investment, the risk of security breaches or hacks, and the risk of regulatory uncertainty. Investors should carefully consider these risks before participating in DeFi yield farming.

How Dev Technosys Can Help You?

Dev Technosys is a leading mobile app development company with more than 10 years of experience creating innovative custom software development. We serve software development services for every type of business, including small to large.

We have a team of dedicated developers that focuses on creating software with exclusive designs, user friendly, and keeping trends alive. We design cutting-edge solutions in different technology platforms, such as jQuery, JavaScript, Ruby on Rails, PHP, AngularJS, HTML5, etc.

So, if you're one of the individuals looking to create a platform for DeFi Farming, you should get in touch with us quickly!

If you're wondering what difference we can offer, look at the special functions we add to building solutions according to your business requirements.

-

Skilled Dedicated Developers

-

Non-Disclosure Contract

-

Dependable Data Security and Privacy

-

Improved Project Management with Cutting-Edge Tools

-

Expertise In Using Latest Tech Stack

-

After-Release Assistance

-

Maintenance & Support

And many more. So hurry up and contact our team to share your app development idea. We'll create a difference in your business by delivering innovation and intelligence in one box.