Are you ready to change the way people handle payments? If yes, this blog is for you.

In today’s digital era, the demand for payment apps is continuously growing and there is no sign of slowing down it. As a result, entrepreneurs are constantly looking for convenient and innovative ways to streamline their transactions while providing easy payment solutions to their customers.

According to a study, the size of the worldwide online payment industry was estimated at USD 3,286.52 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 23.7% to reach USD 17,643.35 billion by 2027. Asia Pacific led online payments with a 34.95% market share worldwide in 2019. As per this data, the payment app has become a lucrative opportunity for businesses looking to tap into their thriving market.

So, if you also want to build an app like Venmo, read this blog till the end. This blog will help you learn about everything you must know to develop a successful payment app.

Quick Summary: Learn how to create an app like Venmo. This blog will also explore its development cost, significant features, and tech stack used. Moreover, learn how payment app development can benefit your business.

What is the Venmo – A Payment App

Venmo is one of the fintech apps that allows users to conveniently transfer or receive money. The app is widely used for sharing rent, splitting bills, or paying family and friends without the need for checks or cakes. Venmo links users’ bank accounts and credit or debit cards and provides a social aspect that enableusers to share payment activity with others. Overall, this app is known for its user-friendly interface, convenience, and minimal fees, making it the first choice for payment solutions for personal transactions.

Market Stats of Mobile Payment Applications

Let’s dive into the market stats of mobile payment apps like Venmo, which will make you understand how its marketing has increased in the past few years.

- As of July 2017, consumers ranked the most crucial payment app features, as shown in this statistic.

- According to poll results, security was regarded as being the most significant element of payment app features that customers thought were highly important.

- According to the survey findings, 77% of users said security was essential for payment applications.

- Five times as many Americans said they had used PayPal than Apple Pay at some point in a January 2021 survey in the U.S.

- PayPal is a more well-known name in the U.S. than its business Venmo. However, the number of people using digital payment methods increased in 2020.

- According to active accounts, the number of PayPal users globally grew by around 24 percent year over year in the final quarter of 2020.

- In parallel, the number of iPhone users who have enabled Apple Pay globally is expected to increase by over 65 million by 2020.

- In digital payments, the transaction value amount is anticipated to reach $8.49 trillion in 2022.

- By 2027, it is anticipated that the entire payment value will have increased by 12.31% each year (CAGR 2022–2027), totaling US$15.17 trillion.

- Digital Commerce is expected to have a total transaction value of US$5.49 trillion in 2022, making it the market’s largest segment.

- A global comparison reveals that China (US$3,497.00 billion in 2022) has the most significant cumulative transaction value.

- By 2023, it is anticipated that about a third of smartphone users in the U.K. will use nearby digital money (smartphone payments conducted in-store). The predicted percentage was just over 19 percent in 2019.

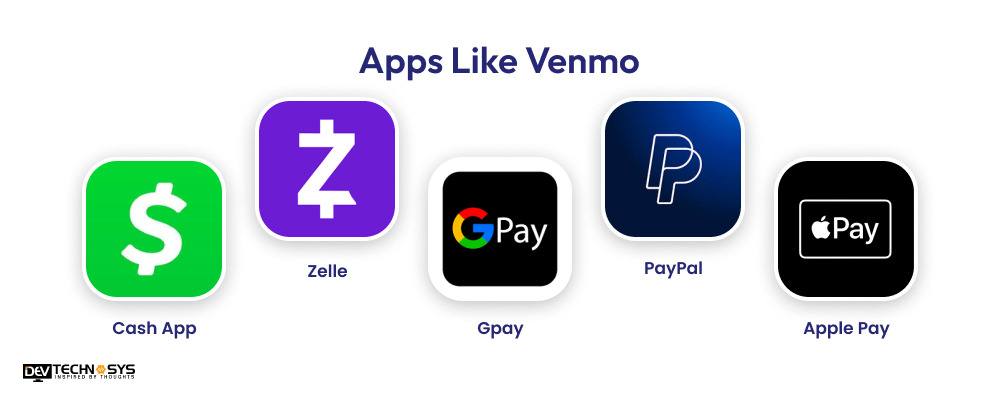

List of Some Incredible Apps Like Venmo

If you want to invest in UPI payment app development services, you have to understand the market landscape. In this section, we have compiled a list of the top trending ewallet apps for money transfer that you can look at for competitor research. Let’s look at the apps similar to venmo.

| List of Apps Like Venmo | Downloads | Release Year | Available Platform |

| Cash App | 50M+ | 2013 | Android | iOS |

| Zelle | 10M+ | 2017 | Android | iOS |

| Gpay | 500M+ | 2015 | Android | iOS |

| PayPal | 100M+ | 2012 | Android | iOS |

| Apple Pay | 10M+ | 2014 | Android | iOS |

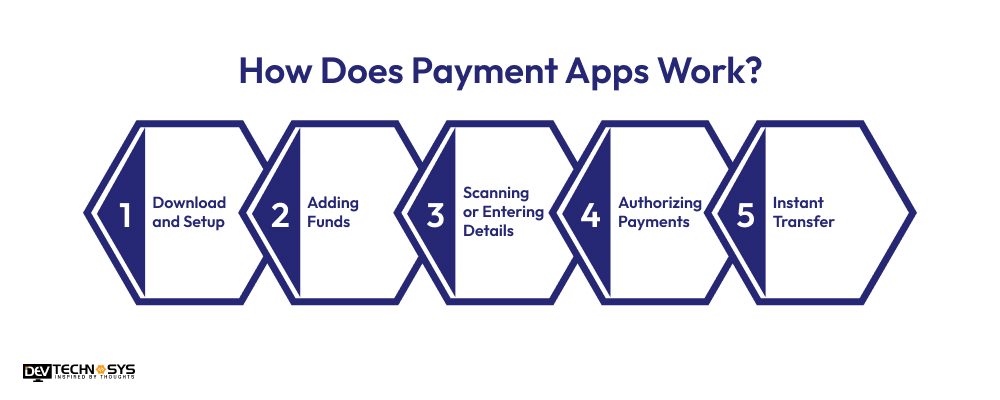

How Do Payment Apps Work?

Now that you know the unique features of payment app development like Venmo, you need to know how it works. In this section, we have covered the working module of online mobile app development like Venmo, which you must learn before diving into development.

1. Download and Setup

First, users need to download the payment app from their device’s app store. Afterward, they must create an account and link their bank or debit/credit card. This process is user-friendly and takes just a minute.

2. Adding Funds

Mostly payment apps enable users to add funds directly from their bank account, ensuring that they have enough funds for transactions. Some other apps offer automatic top-up features, avoiding running out of balance.

3. Scanning or Entering Details

When making a payment, users scan a QR code or can also enter the recipient’s UPI ID or phone number. This step ensures error-free and fast payments, especially via online or transaction.

4. Authorizing Payments

Now, users will be promoted to authorized transactions, often using fingerprint, PIN, or facial recognition. Such security protects users’ financial data and prevents unauthorized transactions.

5. Instant Transfer

After authorization, the specific funds are transferred from the sender’s account to the recipient’s account, eliminating the need for checks or cash. This notifies the recipient that make the process is seamless for both parties (receiver and sender)

5 Benefits of Developing the Payment App

Do you know how it can be beneficial for your business to invest in payment app development? Well, everybody knows how the market of online payment apps is growing, and there is no sign of slowing down it. Still, if you want to know why you must invest in payments software development solutions, consider the following compelling reasons:

1. Increased Revenue Streams

A payment app offers numerous revenue opportunities through premium features, transaction fees, and partnerships with financial institutions or banks. If you build an app like Venmo, you can integrate a loyalty program or advertising that drives additional income streams.

2. Brand Visibility

A well-crafted payment app boosts specific brand visibility. When users share the app with their family and friends for transactions, the app reaches a large audience. Additionally, in-app social features, such as group payment or payment-sharing options, increase exposure and user acquisition.

3. Global Reach

A payment mobile app can easily transcend geographical limitations that enable businesses to enter the international market. If you make an app like Venmo and offer multilingual support and multi-currency, it can attract users from different regions and help entrepreneurs to expand their businesses worldwide.

4. Competitive Edge

If you build apps similar to Venmo, you can gain a competitive edge and tap into the growing digital economy. You can set your app apart from competitors by offering features like enhanced security, lower fees, and seamless integration with popular platforms.

5. Scalability

By investing in payment app development, you can easily scale your app as the user base grows. With regular updates and cloud-based infrastructure, you can accommodate more users, features, and transactions while ensuring good performance and future growth potential.

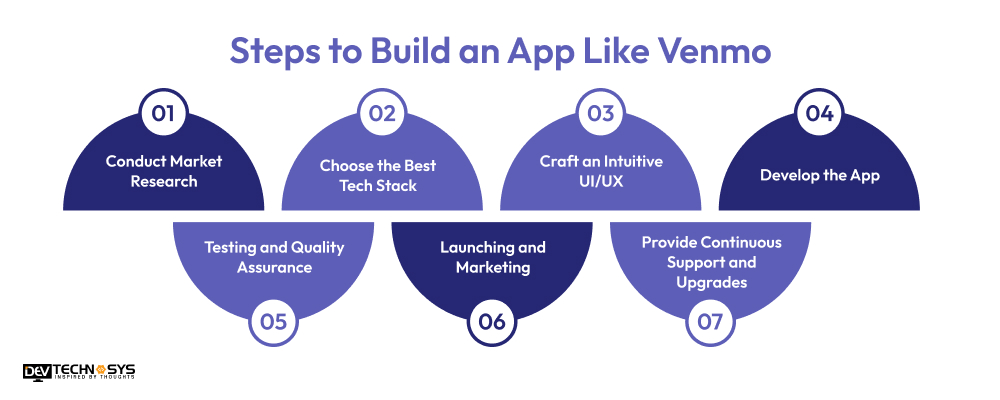

7 Key Steps to Build an App Like Venmo

Are you wondering how to develop an app like Venmo? Well, you must understand that payment app development requires following a series of strategic steps, ensuring the app is functional and competitive in today’s crowded online payment market. Here is a straightforward app development process help you to build an awesome payment app like Venmo:

1. Conduct Market Research

Before you start the payment app development, you must understand the market landscape, competitors, and demand for a peer-to-peer payment solution. And all that is possible with market research, enabling you to identify your target audience and what features they want in your app. This also helps you to understand the competitor’s strength and areas of improvement that you can avoid in your app, enabling you to develop your app accordingly.

2. Choose the Best Tech Stack

Now, choose a robust tech stack that matches your project requirements. To build an app like Venmo, you will need technologies that support fast and secure transactions. If you are facing problems choosing a suitable tech stack, it would be better for you to hire a fintech app development company with a deep knowledge of the technologies used in app development. However, when choosing a tech stack, consider the factors, security, performance, and scalability.

3. Craft an Intuitive UI/UX

Now, let’s focus on user interface (UI) and user experience (UX), keeping users engaged. You must design an experience that makes money receiving and sending quickly and easily, with just a few clicks. You can attract more customers with a visually appealing, user-friendly, and easy-to-navigate interface. Also, with the help of a mobile app design company, ensure to integrate the personalization features, like transaction histories and balance checks to enhance the user journey with your payment apps.

4. Develop the App

As now the actual development of the payment app starts, you should adopt agile methodologies for better outcome. Hire Android app developers to build core features like peer-to-peer payment, user authentication, and real-time notification. Furthermore, to build an app like Venmo, implements advanced security measures such as multi-factor authentication and encryption, ensuring user safety.

5. Testing and Quality Assurance

Testing and quality assurance is one of the significant steps in ensuring a successful app launch. At this stage, a mobile banking app development company conducts thorough performance, security, and functional testing so that potential bugs can be identified and resolved before the app reaches the audience. Furthermore, testing with real users through trials provides valuable insights as it allows businesses to improve the app’s user interface, functionality, and overall experience.

6. Launching and Marketing

Once your app is ready to launch, you are advised to make a strong marketing strategy to stand out in today’s competitive market. This involves ASO (app store optimization) to improve visibility that ensures your app ranks higher in search results. Additionally, content marketing, social media, and strategic partnership can help you create a buzz around your app, driving engagement and downloads.

7. Provide Continuous Support and Upgrades

Your work is not done after the app launches. You must understand that continuous support is significant to maintain user satisfaction. Ask the ewallet app development company to address user concerns to build loyalty and trust. You are advised to be aware of your app’s performance, collect feedback, add new features, and keep your app updated according to the latest market trends and technologies.

Working with Dev Technosys- a mobile application development company, is a game-changer for our payment platform. Their expertise in app development, commitment to quality, and attention to detail, lead to an efficient and seamless platform. I highly recommend Dev Technosys to those looking to start a payment app development business.

-Matt Jensen

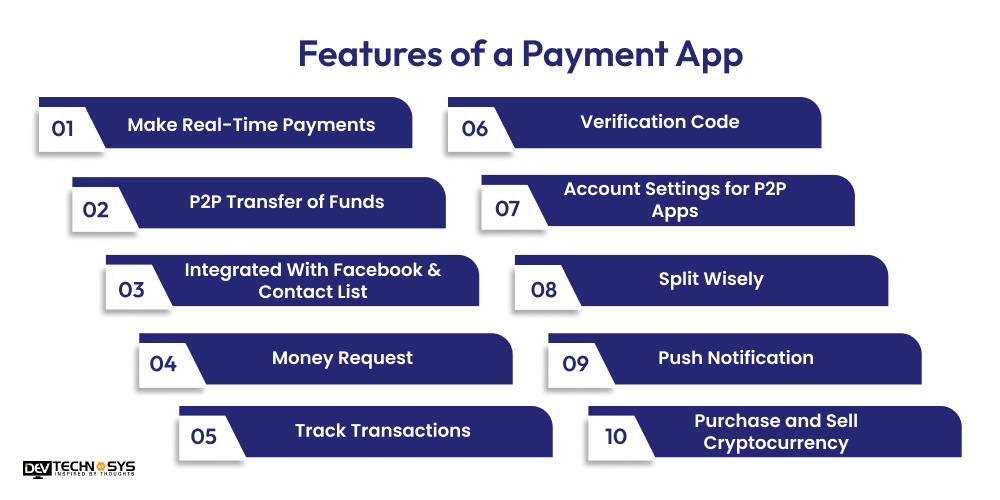

10 Must-have Features of a Payment App

Let’s go through some key features for a successful custom mobile application development, which make them famous. Here we have mentioned some of the most fantastic features used in apps like Venmo, which you should know:

1. Make Real-Time Payments

Making real-time transactions is the fundamental function of payment apps like Venmo. It is vital to know that apps like Venmo allow users to send money to other users and offer P2P services to make it simple to send money.

2. P2P Transfer of Funds

Venmo has the feature of peer-to-peer financial transactions, which makes fund transfers more straightforward and more practical. Here, users need to link their bank account to the app to make bank transfers.

3. Integrated With Facebook & Contact List

The most crucial feature of Venmo is its synchronization with Facebook and its contact list. Users of Venmo can connect their Facebook connections and phone book, which will help them search for people in their contact list in one go.

4. Money Request

Build an app like Venmo that allows users to request money from other people. Users can ask for money using the app’s in-app messaging feature, which will help them make the request known to other users.

5. Track Transactions

It is vital to know that the users of the payment apps like Venmo application can track payments in compliance with established banking standards. The payment app notifies users of their previous transactions via monthly or quarterly emails.

6. Verification Code

The app has payment gateway integration with a multi-code authentication process known as a PIN code. The PIN code protect the Venmo app and kept it secure, preventing anyone from using it without entering the PIN.

7. Account Settings for P2P Apps

Users of the apps like Venmo can access a variety of P2P payment systems, including the settings menu. With this feature, users can view the most recent data on their payment preferences.

8. Split Wisely

Hire iPhone or Android app development company to install this features so that users can effortlessly split bills with pals. This enables users to quickly share bill within the app.

9. Push Notification

This feature is helpful for users of Venmo as it alerts on every send or receive money. The e-wallet app user is informed of any activities or modifications via notifications.

10. Purchase and Sell Cryptocurrency

Peer-to-peer payment apps like Venmo added capabilities that let users purchase. Payments apps like Venmo have traded in cryptocurrencies like bitcoin, and others are growing in popularity, which makes Venmo’s user base may grow significantly.

Cost to Build an App Like Venmo

If you are developing a payment app like Venmo, you might also be wondering about its development cost. Well, there are no fixed costs for payment app development as numerous elements, such as app design, development team, app feature, etc. impact the cost. However, for a general estimation, we can consider $8000 to $27000 as the overall fintech app development cost. Moreover, based on the projects’ comepxlity the cost can fluctuate as mentioned in the table below:

| Payment App Development | Estimated Cost | Time Frame |

| Simple Payment App Development | $8000 – $13000 | 3 to 6 Months |

| Medium-Complex Payment App Development | $13000 – $21000 | 6 to 9 Months |

| High-Complex Payment App Development | $27000+ | 10+ Months |

What Factors can Impact the Development of Online Payment Apps?

Now that you have learned about the cost to develop an e-wallet app, you must also learn what factors can influence the cost. As there is a range of the cost-influencing factors, here is the list of key factors that majorly contribute to the additional cost and you must know about :

1. App Features and Functionalities

The features and their complexity level directly impact the online payment app development cost. If you want to simply make an app with basic features like user registration, transaction history, and payment processing, it requires less investment. However, if you want to create a feature-rich app, you must spend more, contributing to the overall development cost.

2. Expertise in Development Team

As you are developing an online payment app, you might need to hire mobile app developers. However, they will command high rates if you want to hire a skilled team familiar with cybersecurity, payment gateway integration, and compliance with industry standards. On the other hand, hiring junior or less experienced developers means you have to spend less, reducing the app development cost.

3. User-experience Design

As you know, it’s critical to ensure a user-friendly and seamless interface to retain users. Hence, you are advised to design an intuitive and simple UX while ensuring robust functionality that can extend development time and cost. However, remember that if you focus on a well-crafted design, you must spend more, increasing Venmo like app development costs.

4. Security Measures

It’s critical to ensure high-end security in online payment apps. Hence, if you build an app like Venmo, you need to implement two-factor authentication, encryption, and other anti-fraud measures. As a result, these security protocols add to the project’s complexity and cost, increasing the mobile app development cost.

5. Chosen Platform (Android, iOS, or cross-platform)

The platform you choose to build your app on influences the app development cost. Building an app for Android and iOS can be more costly and time-consuming than opting for a cross-platform approach using a framework like React Native or Flutter.

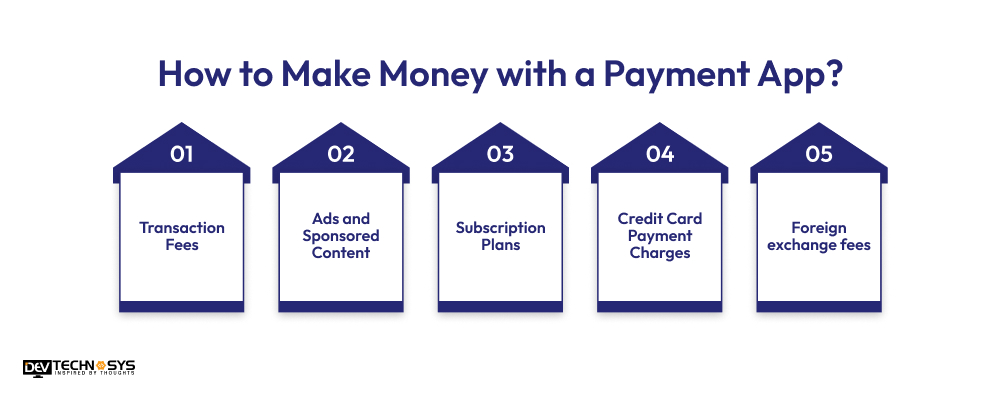

How to Make Money With a Payment App?

Developing a payment app is undoubtedly an excellent business opportunity; however, how do we make money from the app? You have come to the right place if you are also searching for the same. Let’s dive into top 5 effective monetization methods to earn money with the app:

1. Transaction Fees

It’s one of the easiest ways to earn money with your payment app. You can charge a transaction fee or flat fee whenever users receive or send money. For instance, if you build an app like Venmo, you can charge a small percentage for instant transfer. The amount might seem small, but with many users, this small amount can quickly add to a significant profit.

2. Ads and Sponsored Content

You can show ads in apps similar to venmo from businesses or promote special offers from the partners. However, remember that this does not become annoying for users. So, run the ads relevant to the user’s shopping habits. This type of ads keeps users engaged while ensuring you earn your revenue.

3. Subscription Plans

If you build apps similar to venmo, you can offer premium features through subscription plans. If they want extra benefits, like increased security, faster transfer, or premium customer support, they have to pay a yearly or monthly fee. You are advised to give users a taste of premium features, encouraging them to pay regularly for advanced features.

4. Credit Card Payment Charges

It is essential to know that amounts paid with a debit card are free. However, as per the on demand app development companies, payment apps like Venmo set a flat commission of 3% when you send money using a credit card. Additionally, this time-honored method of funding is used by many fintech applications.

5. Foreign Exchange Fees

With your app, you can allow international transfers and charge a small fee for currency conversion. When dealing with frequent transfers or large sums, even a small difference in exchange rates can generate a significant profit. Hence, this approach can significantly enhance the revenue stream.

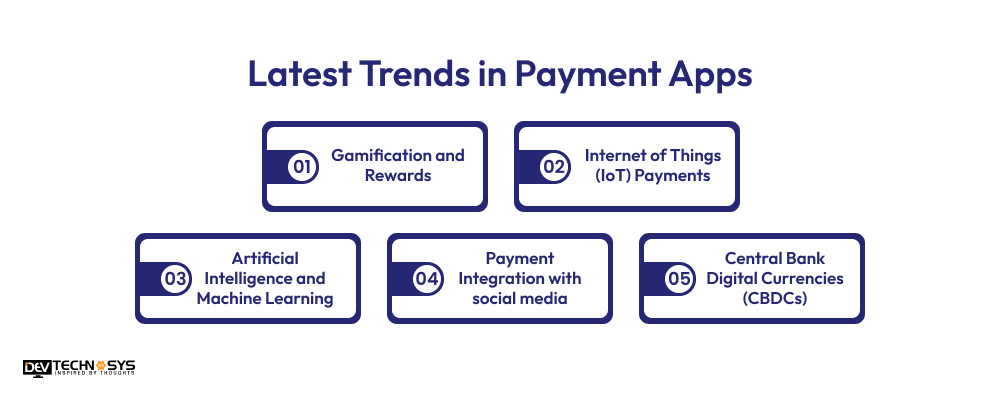

5 Latest Trends in Payment Apps

The online payment industry is witnessing a major transformation driven by technological advances and customers’ changing preferences. Hence, if you want to stay competitive in today’s competitive market, consider the following trend to build an app like Venmo:

1. Gamification and Rewards

Incorporating gamification elements, payment apps similar to venmo enhance user engagement and loyalty. This involves adding features like badges, points, and leaderboards that transform transactions into a rewarding and fun experience. Discounts or cashback offers reward programs that incentivize users to adopt and continue using a payment app.

2. Internet of Things (IoT) Payments

IoT blends with payments, creating new opportunities for convenient and seamless transactions. Smart devices or wearable appliances can be integrated with mobile payment apps to ensure secure and quick payments. For instance, if users use smartwatches to pay for groceries at a self-checkout station, this will eliminate the need for physical cards.

3. Artificial Intelligence and Machine Learning

ML and AI play a critical role in enhancing the capabilities of online payment platforms. You can ask an IT consulting firm to integrate AI and ML into your app. These technologies personalize recommendations, detect fraud, and improve customer services. For example, AI-based chatbots can resolve customer inquiries and provide instant support efficiently.

4. Payment Integration with Social Media

Nowadays, social media platforms are becoming intertwined with online payment systems. Hence, with this integration, users can make purchases directly within their preferred social apps, simplify the checkout process, and enhance the shopping experience. For instance, users might purchase anything from other’s posts on Instagram without leaving the app.

5. Central Bank Digital Currencies (CBDCs)

Across the world, central Banks are exploring the development of CBDCs, which are digital versions of fiat currencies. This trend can change how people make payments by offering greater security, accessibility, and efficiency. CBDCs could also provide financial inclusion for underserved populations.

Tech Stack for Payment App Development

Well, creating a payment app requires a secure and robust tech stack to ensure a smooth transaction, user experience, and scalability. A combination of programming language, cloud solutions, and framework contribute to successful app development. You can get assistance from a payment app development company to choose the best stack. If you want to know more, here are some key components you must consider to build an app like Venmo

| Component | Technologies |

| Frontend | React Native, Flutter, Swift, Kotlin |

| Backend | Node.js, Java (Spring Boot)

Python (Django/Flask), |

| API Integration | GraphQL, RESTful APIs, SOAP |

| Database | SQLite, PostgreSQL,MySQL, MongoDB, Firebase |

| Analytics | Google Analytics, Firebase Analytics |

| Authentication | OAuth, JWT |

| Push Notifications | Apple Push Notification Service, Firebase Cloud Messaging |

| Version Control | Git, GitHub, Bitbucket |

| Deployment | Apple App Store, Google Play Store, TestFlight, Firebase App Distribution |

Wrapping Up!

With this blog, you might understand how investment in payment app development can be a lucrative business opportunity for entrepreneurs. With the growing demand for secure and convenient payment solutions, there is a massive opportunity to capitalize on this market. Hence, it’s the right time to enter the market and differentiate yourself with unique offerings.

If you also want the same and build an app like Venmo, you must collaborate with a skilled on demand app development company like Dev Technosys. We leverage cutting-edge technology, enabling businesses to build a user-friendly payment app that has the potential to change the way businesses handle transactions.

So what are you waiting for? Share your project requirements with us, and take your business to the next level.

Frequently Asked Questions

1. How Much Does It Cost to Build an App Like Venmo?

The cost to build a mobile app is:

- Simple Payment App Development – $8000 – $13000

- Medium-Complex Payment App Development – $13000 – $21000

- High-Complex Payment App Development – $27000+

2. How Long Does It Take to Build an App Like Venmo?

The time to build payment apps like Venmo depends on their complexity level and project requirements. If you develop a simple app, the time would be around 3 to 7 months. At the same time, the time to develop a complex app would be around one year.

3. What is the Business Model of Venmo?

Payment apps like Venmo use a business model to gather fees from users and merchants. It is vital to know that Venmo doesn’t charge users for transferring money directly (peer-to-peer). However, payment applications generate money via fees, affiliate partnerships, and withdrawals.

4. What Technologies Does Venmo Use?

Suppose you’re about to develop a react native mobile app like Venmo. In that case, you must know it has ten technology products and services induced, such as HTML5, jQuery, and Google Analytics, according to G2 Stack. Additionally, payment apps like Venmo actively utilize 31 technologies on their website, which include Nginx, Viewport Meta, and iPhone/Mobile Friendly.