“Make your business fast with online digital payment apps like Amazon Pay.”

Are you amazed by the way Amazon pay works? If yes, then you must be using similar applications for doing online payments. This may be the same with most people across the world. Businesses must see a great potential in these platforms and start investing money to build an app like Amazon Pay. It will be helpful for small enterprises who want to make their business processes faster.

The use of online payment apps is increasing daily, contributing economically and financially. At least 8 out of 10 people have registered accounts on online payment gateways. So, you should create an Amazon Pay app clone to target more users.

For that, you need to know various development related aspects like features, cost, process, and money earning methods. This blog includes everything for you. So, let us move ahead to understand better.

What is Amazon Pay?

Amazon Pay is a digital payment service by Amazon that allows users to make secure and seamless transactions on third-party websites, mobile apps, and Amazon itself. It enables customers to use their existing Amazon account credentials and payment methods for fast checkouts. Amazon Pay supports multiple payment options, including credit/debit cards, UPI, and net banking, ensuring convenience for users.

Businesses can integrate the best Ewallet applications like Amazon Pay to enhance customer experience and reduce cart abandonment. With advanced security features, fraud protection, and voice-enabled transactions via Alexa, Amazon Pay provides a reliable and user-friendly payment solution for both consumers and merchants.

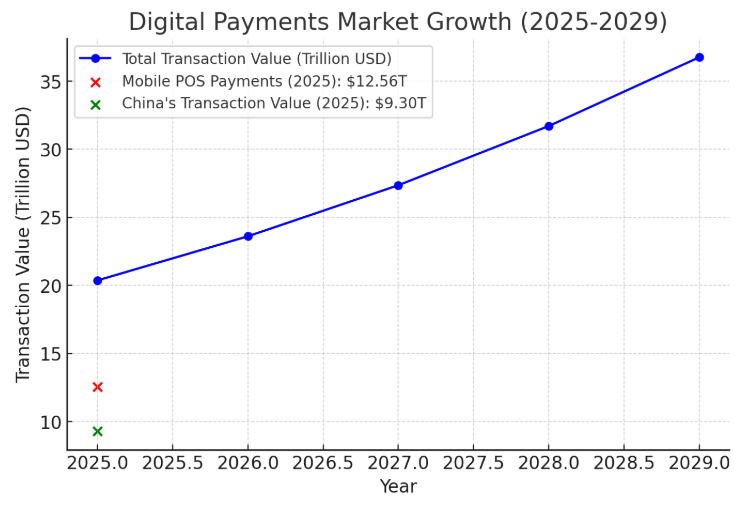

Market Stats of Fintech Industry

- In 2025, the digital payments market is expected to achieve a total transaction value of $20.37 Trillion.

- It is anticipated that the total transaction value will grow at a rate of 15.90% CAGR between 2025 to 2029, reaching a predicted total of $36.75 Trillion by 2029.

- With an estimated total transaction value of $12.56 Trillion in 2025, mobile point-of-sale payments are the market’s largest segment.

- According to a global comparison, China achieved the highest total transaction value in 2025, with $9.30 Trillion.

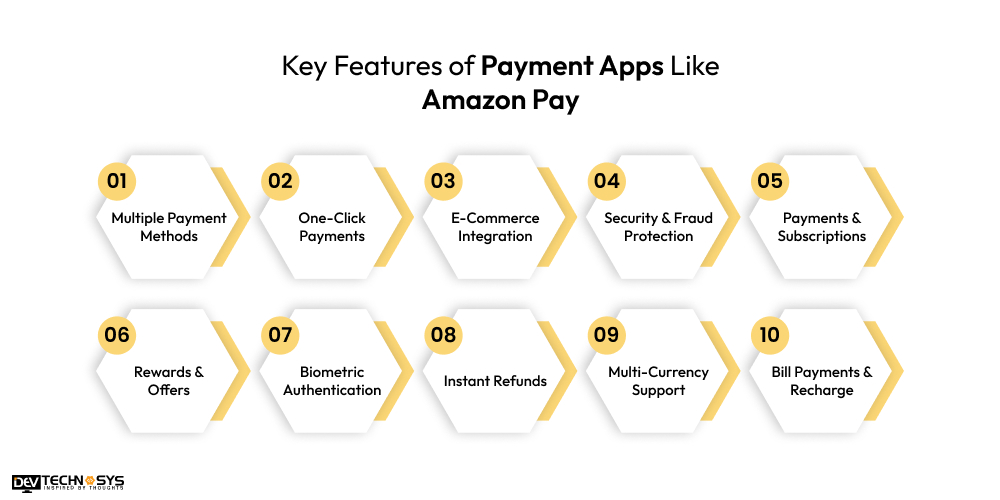

Key Features of Payment Apps Like Amazon Pay

For businesses, it is necessary to know mobile wallet app development features to build payment apps like Amazon Pay for quick and easy digital transactions. Let us study major features in this section:

1. Multiple Payment Methods

Numerous payment methods, such as digital wallets, UPI, credit/debit cards, and online banking, are supported by payment apps. Users can select their preferred technique for smooth transactions because of this flexibility.

2. One-Click Payments

An app like Venmo helps users to make quick and easy transactions by safely saving their payment information. This speeds up the checkout process and improves the whole buying experience.

3. E-Commerce Integration

Customers may make purchases using the app without being sent to third-party payment gateways because it seamlessly links with online retailers. This reduces cart abandonment and increases conversion rates.

4. Security & Fraud Protection

To safeguard transactions, payment apps use two-factor authentication (2FA), encryption, and AI-powered fraud detection. These safeguards aid in preventing unwanted access and safeguarding private user information.

5. Payments & Subscriptions

For regular costs like insurance premiums, streaming services, and electricity bills, users can program automated payments. You can build an E-wallet app like Apple Pay that has a similar feature that lowers the possibility of missing deadlines.

6. Rewards & Offers

To encourage users, a lot of payment apps provide loyalty benefits, discount coupons, and cashback. These promos improve customer retention and promote repeat business.

7. Biometric Authentication

For safe and practical transactions, an app like Cash combines voice commands with biometric verification like facial or voice recognition and fingerprint. This lessens reliance on passwords while improving security.

8. Instant Refunds

Payment applications offer a dedicated dispute resolution support system and guarantee prompt refunds for unsuccessful or canceled transactions. Customer satisfaction and trust are increased as a result.

9. Multi-Currency Support

Real-time currency conversion enables users to conduct cross-border transactions, simplifying international shopping. An Amazon Pay app clone allows businesses to operate globally through this feature.

10. Bill Payments & Recharge

Through the program, users may pay for broadband connections, utility bills, and mobile recharges from their virtual wallet. It is highly beneficial to develop an Ewallet app like Paytm that delivers a similar financial solution.

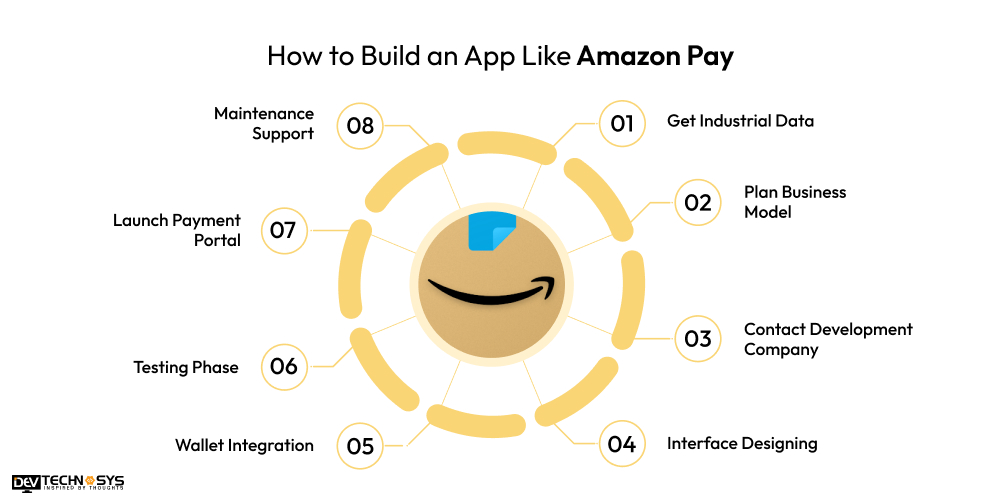

How to Build an App Like Amazon Pay?

In this section, we will deeply understand a generally accepted process to create an app like Amazon Pay. So, let us move forward to understand sequential development stages here:

1. Get Industrial Data

Businesses should first conduct in-depth market research to analyze user interests, application features, and industrial trends. Additionally, it is necessary to use fintech app development services for gathering desired security regulations like PCI DSS, GDPR and digital payment standards.

You should identify key points and innovations to ensure that the payment app meets the current and future market demands. Studying use cases is the main task at this stage.

|

2. Plan Business Model

It is necessary to make an app like Amazon Pay with an applicable revenue model, such as transaction fees, premium subscriptions, or merchant partnerships. You should determine whether it will focus on business, consumer, or peer-to-peer transactions.

A well-structured business plan will guide you through the development process and attract potential investors. You can easily list the budget through a documentation method.

|

3. Contact Development Company

Investors must choose an experienced Ewallet app development company based on expertise, portfolio, and industrial knowledge. It is important to decide between hiring in-house developers, outsourcing to agencies, or working with freelancers.

You must ensure the team understands security requirements and payment gateway integrations. Before investing money in the Amazon Pay app development you should follow a suitable hiring process.

|

4. Interface Designing

Now, the primary stage in the process to make an app like Amazon Pay is to start creating a user-friendly and intuitive UI/UX design that simplifies transactions for users and merchants. Focus on minimum navigation process, secure login methods, and a responsive interface.

Businesses can use prototyping and wireframing tools like Figma or Adobe XD to easily visualize an Amazon Pay clone app before development.

|

5. Wallet Integration

To integrate digital wallets, bank linking, and payment gateways like PayPal you must contact an Amazon Pay development Company. It will help you to enable multi-currency support, QR code payments, and contactless transactions.

Additionally, this ensures compliance with financial regulations and incorporates strong encryption for security. For making Amazon Pay alternatives with dynamic digital wallet, you need to implement this stage.

|

6. Testing Phase

For conducting rigorous testing, including functionality, security, and user experience testing you should hire Ewallet developers. They can easily simulate real-world transactions to detect bugs, security vulnerabilities, or system inefficiencies.

Additionally, they can perform regulatory audits and penetration testing to ensure the app meets regulatory standards.amazon pay developer

|

7. Launch Payment Portal

Now, you can deploy the application on platforms like Google Play Store and Apple App Store. Industry professionals must hire Amazon Pay app developers to implement marketing strategies, partnerships, and promotions to attract users from all over the world.

You must ensure a smooth onboarding process with tutorials and customer support in place. At first, you have to give your services for free to gain user trust and loyalty.

|

8. Maintenance Support

Maintenance of mobile apps involves monitoring for bugs, security threats, and performance issues. The use of E-wallet app maintenance services can provide regular updates to improve features, compliance standards, and user experience.

It offers customer support, fraud prevention, and quick issue resolution to maintain trust and user retention. You can also update platform features without spending any extra cost.

|

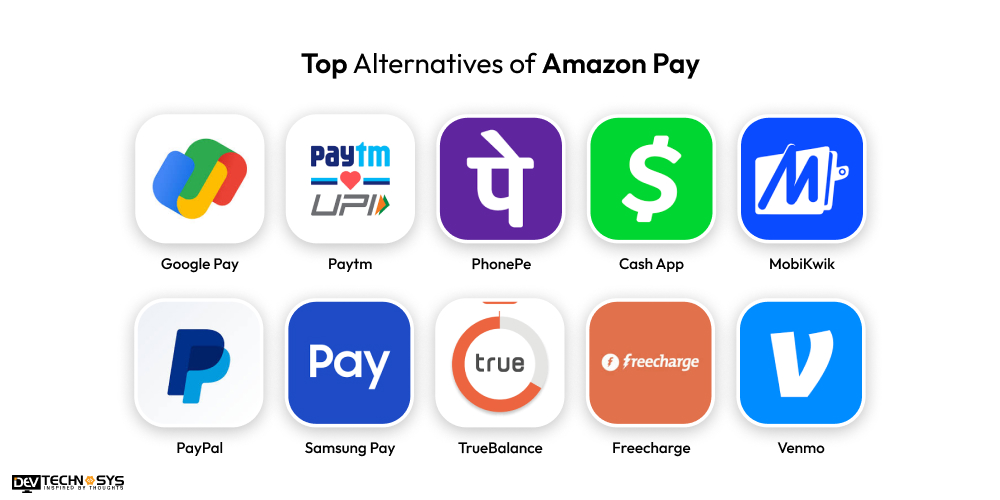

Top Alternatives of Amazon Pay

Although Amazon Pay is a popular digital payment service, a number of different platforms provide comparable services. You need to know the differences between digital wallet vs mobile wallet to study these alternatives to offer bill paying and online purchasing features. These are a few of the best Amazon Pay alternatives that consumers and investors should think about.

Top 10 Amazon Pay Alternatives |

Supported Devices |

Downloads |

Ratings |

| Google Pay | Android|iOS | 1B+ | 4.0 |

| Paytm | Android|iOS | 500M+ | 4.6 |

| PhonePe | Android|iOS | 500M+ | 4.2 |

| Cash App | Android|iOS | 100M+ | 4.6 |

| MobiKwik | Android|iOS | 100M+ | 4.4 |

| PayPal | Android|iOS | 100M+ | 4.3 |

| Samsung Pay | Android|iOS | 100M+ | 4.3 |

| TrueBalance | Android|iOS | 50M+ | 4.4 |

| Freecharge | Android|iOS | 50M+ | 4.3 |

| Venmo | Android|iOS | 50M+ | 4.1 |

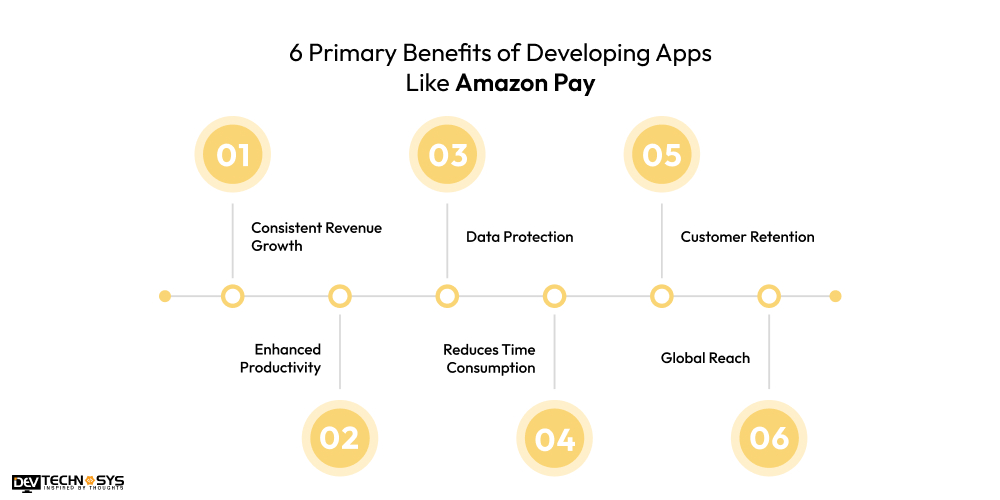

6 Primary Benefits of Developing Apps Like Amazon Pay

Investment of money in Ewallet app development to build apps similar to Amazon Pay allow businesses to improve financial transactions and user experience. Through rewards and smooth integrations, these apps increase user engagement, expedite online payments, and enhance security.

1. Consistent Revenue Growth

Transaction fees, merchant relationships, and premium services are how payment applications make money. Businesses may draw in more customers by providing smooth transactions and incorporating a variety of payment options. A well-designed payment app can also act as a financial center for other services, such as recharges and bill payments.

2. Enhanced Productivity

User happiness is increased and checkout friction is decreased with a simple and easy payment process. A hassle-free experience is produced with features like biometric authentication and one-click payments. It is beneficial to contact a fintech app development company for Higher retention rates.

3. Data Protection

To protect transactions, payment apps use multi-factor authentication, encryption, and AI-powered fraud detection. More digital transactions are encouraged by secure payment infrastructures, which increase consumer and corporate trust. These security elements aid in preventing data breaches and illegal access.

4. Reduces Time Consumption

E-commerce systems may readily incorporate payment apps, enabling companies to provide a seamless checkout process. The use of Ewallet app development services increases conversions and lowers cart abandonment rates. Fast settlements and transaction analytics help merchants maximize sales.

5. Customer Retention

Users are encouraged to favor a certain payment app by cashback offers, reward points, and special discounts. These rewards increase the frequency of transactions and foster long-term client engagement. Data analytics can also be used by businesses to enhance retention tactics and personalize offers.

6. Global Reach

A well-designed payment app can increase its user base by supporting multi-currency and international transactions. Businesses can expand their financial footprint by using android app development services to serve both domestic and international markets. Scalability guarantees that the application maintains its effectiveness as transaction volumes increase.

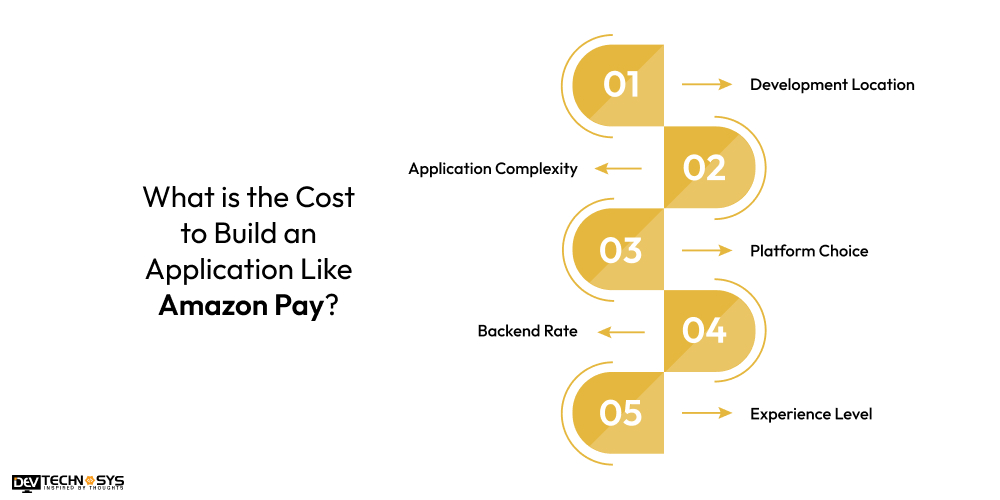

What is the Cost to Build an Application Like Amazon Pay?

A number of variables, such as platform, developer experience, location, and complexity, affect the cost to develop an app like Amazon Pay. The cost to build an EWallet app with feature-rich, enterprise-level solutions is more than the average market rate, whereas a basic app might cost under the budget limit. Let’s take a closer look at the main elements that affect costs.

1. Development Location

Regional differences in developer rates have an impact on the total cost to build an app like Amazon Pay. For instance, employing developers in India or Eastern Europe costs less than recruiting developers in North America or Western Europe. Selecting an offshore development team allows the cost to develop an app like Amazon Pay to get reduced without sacrificing quality.

Location Factor |

Estimated Cost |

| USA | $25000-$30000 |

| Australia | $20000-$25000 |

| India | $5000-$12000 |

| UK | $15000-$20000 |

| UAE | $8000-$15000 |

| Brazil | $12000-$16000 |

2. Application Complexity

The cost to build an app like Amazon Pay for a simple payment app that includes necessary functions like payments and transaction history is dependent on complexity level. A more sophisticated program with comprehensive analytics, multi-currency functionality, and AI fraud detection can cost more than average market rate. The Ewallet app development cost and duration increase with the number of features and connectors introduced.

Platform Classification |

Development Time |

Estimated Cost |

| Simple | 2-5 months | $5000-$10000 |

| Moderate | 5-8 months | $10000-$15000 |

| Complex | 8-12 months | $15000-$20000 |

| Premium | More than 12 months | $20000-$25000 |

3. Platform Choice

Building a cross-platform application with Flutter or React Native is less expensive than creating separate native apps for iOS and Android. A multi-platform software can cost more than usual applications, whereas a single-platform app can be included within the budget. The target audience and money determine the best course of action.

Development Platform |

Estimated Cost |

| Flutter App | $15,000-$20,000 |

| Native App | $20,000-$25,000 |

| Hybrid App | $25,000-$30,000 |

4. Backend Rate

Investments in database administration, API development, and cloud services like AWS and Google Cloud are necessary for a scalable and secure backend. Backend expenses are less for a basic setup and high for a high-end infrastructure, depending on traffic and security requirements. The crypto wallet development cost is also increased by security compliance.

Backend Infrastructure |

Estimated Cost |

| Databases | $8,000-$10,000 |

| API Integration | $10,000-$15,000 |

| Node Installation | $15,000-$17,000 |

| React Framework | $17,000-$20,000 |

5. Experience Level

Although junior developers are reasonably priced, they might not have the necessary security and scalability knowledge. Senior developers are best suited for complicated, enterprise-grade systems, whereas mid-level developers strike a compromise between price and experience. The initial Amazon Pay app development cost is larger but the final output is better with a more experienced workforce.

Team’s Expertise Level |

Cost Estimation |

| Junior/Entry-Level | $8000-$12000 |

| Mid-Level/Experienced | $12000-$16000 |

| Senior/Expert | $16000-$20000 |

| Professional | $20000-$24000 |

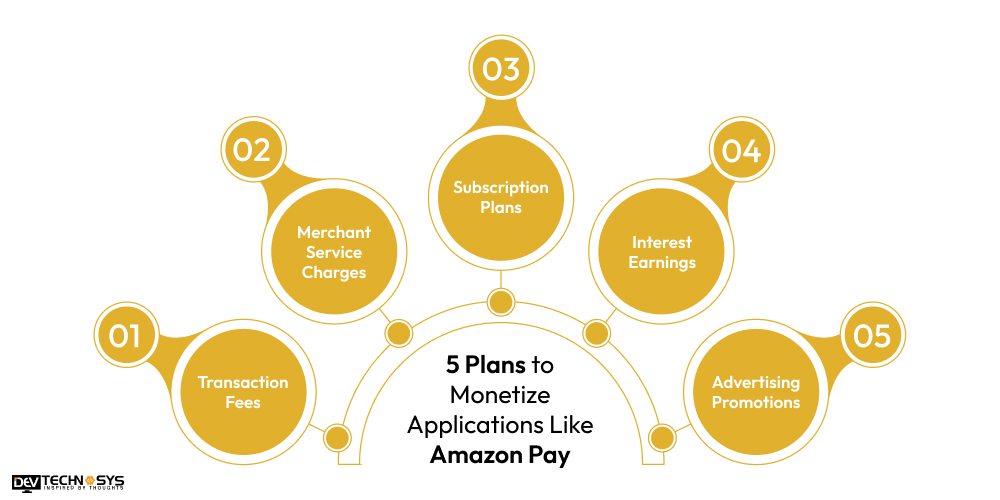

5 Plans to Monetize Applications Like Amazon Pay

Beyond transaction processing, creating a payment software similar to Amazon Pay offers several revenue streams. Businesses may improve user experience and merchant relationships while generating steady revenue by utilizing effective monetization approaches.

1. Transaction Fees

Payment applications make money by taking a tiny cut of each transaction that is completed via their system. The use of UPI payment app development services can help you to cover bill payment and merchant fees. Over time, higher transaction volumes generate a substantial amount of revenue.

2. Merchant Service Charges

Each successful sale or payment processing incurs a fee for businesses utilizing the payment gateway. At extra expense, premium services like quicker settlements and improved analytics may be provided. This guarantees a consistent revenue stream for the platform while offering merchants insightful information.

3. Subscription Plans

Recurring revenue can be generated by providing premium benefits through subscription plans, such as large transaction limits, and exclusive discounts. Businesses can develop an E-wallet mobile app like Google Pay for users where they can pay for memberships to get more features. This arrangement guarantees a steady flow of revenue.

4. Interest Earnings

A portion of interchange fees from credit/debit card transactions are paid to payment apps that collaborate with banks and other financial institutions. Furthermore, money stored in digital wallets can be invested to earn interest. The whole profitability of the business is influenced by this passive revenue strategy.

5. Advertising Promotions

Ad revenue is produced by displaying targeted advertisements or endorsing partner companies within the app. In order to earn commissions on successful sales, you can build an E-wallet app like Freecharge to offer unique promotions. In addition to increasing user engagement, this generates extra income.

Finally!!

What have you observed? A complete guide to create an app like Amazon Pay with cost, benefits, and monetization ways to generate good revenue. It is mandatory to focus on the below points before starting the development of an Amazon Pay clone app.

- Examine various digital wallet trends presently active in the fintech industry.

- Identify important elements like cost, features, and development tools.

- Choose suitable Amazon Pay development services that are affordable.

- Target remarkable monetary solutions for global revenue generation.

- Keep users engaging and interested in your platform.

These are the major checkpoints that you have to cross and qualify to get successful. You have multiple opportunities to start an online business by taking industrial help. So, gather all your resources and begin without wasting any time.

FAQs

Q1. What is the Time Required to Build Apps Like Amazon Pay?

Depending on its complexity, a payment software such as Amazon Pay can take anywhere from six months to eighteen months to develop. A complex app with AI fraud detection, multi-currency compatibility, and high security can take more than 12 months to develop, whereas a basic version with basic functions might take between 6 to 9 months.

Q2. How to Hire an E-wallet App Developer?

- Describe the app’s functionality and security requirements such as GDPR and PCI DSS.

- Seek out developers with e-wallet app development and financial experience.

- Use frameworks like React Native and programming languages like Swift and Java.

- Select between development agencies or independent developers.

- Make sure there is clear maintenance planning and efficient communication.

Q3. How Much Does it Cost to Hire Mobile App Developers?

Project needs, expertise level, and location all affect how much it costs to hire mobile app developers. Senior experts charge $40 to $50 per hour, mid-level developers $25 to $40 per hour, and junior developers $10 to $25 per hour. Depending on the area and skill level, hiring a specialized development team can cost anywhere from $10,000 to $30,000 annually.

Q4. What is the Cost to Maintain an App Like Amazon Pay?

The annual cost of app maintenance usually falls between 15% and 20% of the overall cost of development. Annual maintenance for an app like Amazon Pay can range from $3,000 to $5,000 and include server hosting, security updates, bug patches, and new feature additions. Scaling, security compliance, and third-party integrations all result in higher costs.

Q5. What are the Tools Used to Develop Payment Applications?

- Programming Languages – Swift (iOS), Kotlin/Java (Android), and React Native.

- Backend Development – Node.js, Python (Django), and Ruby.

- Payment Gateways – Stripe, PayPal, and Razorpay.

- Security & Compliance – Tools like OAuth, JWT, and Firebase Authentication.

- Cloud & Database Solutions – AWS and Google Cloud with MySQL or MongoDB.